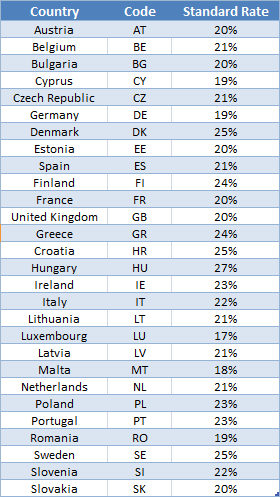

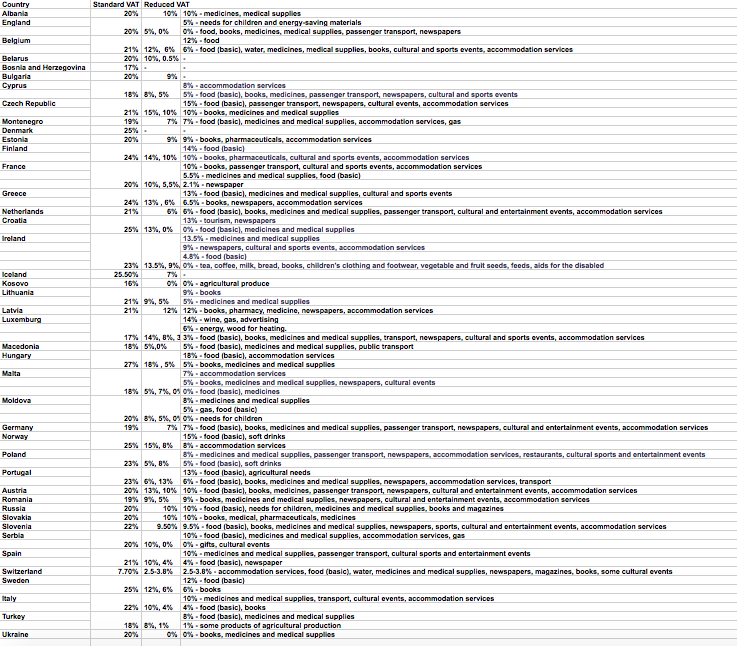

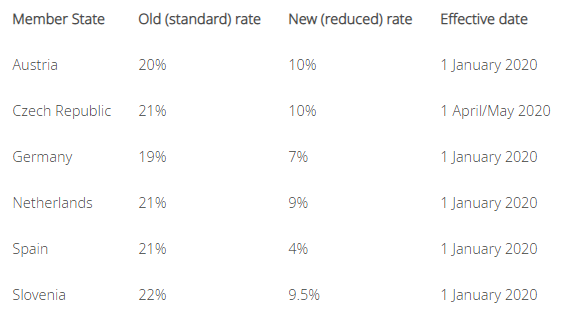

Germany: VAT rate reduced from 19 to 16 percent and tax rate will drop from 7 to 5 percent between July 1 and Dec 31, 2020. German VAT - Global VAT Compliance

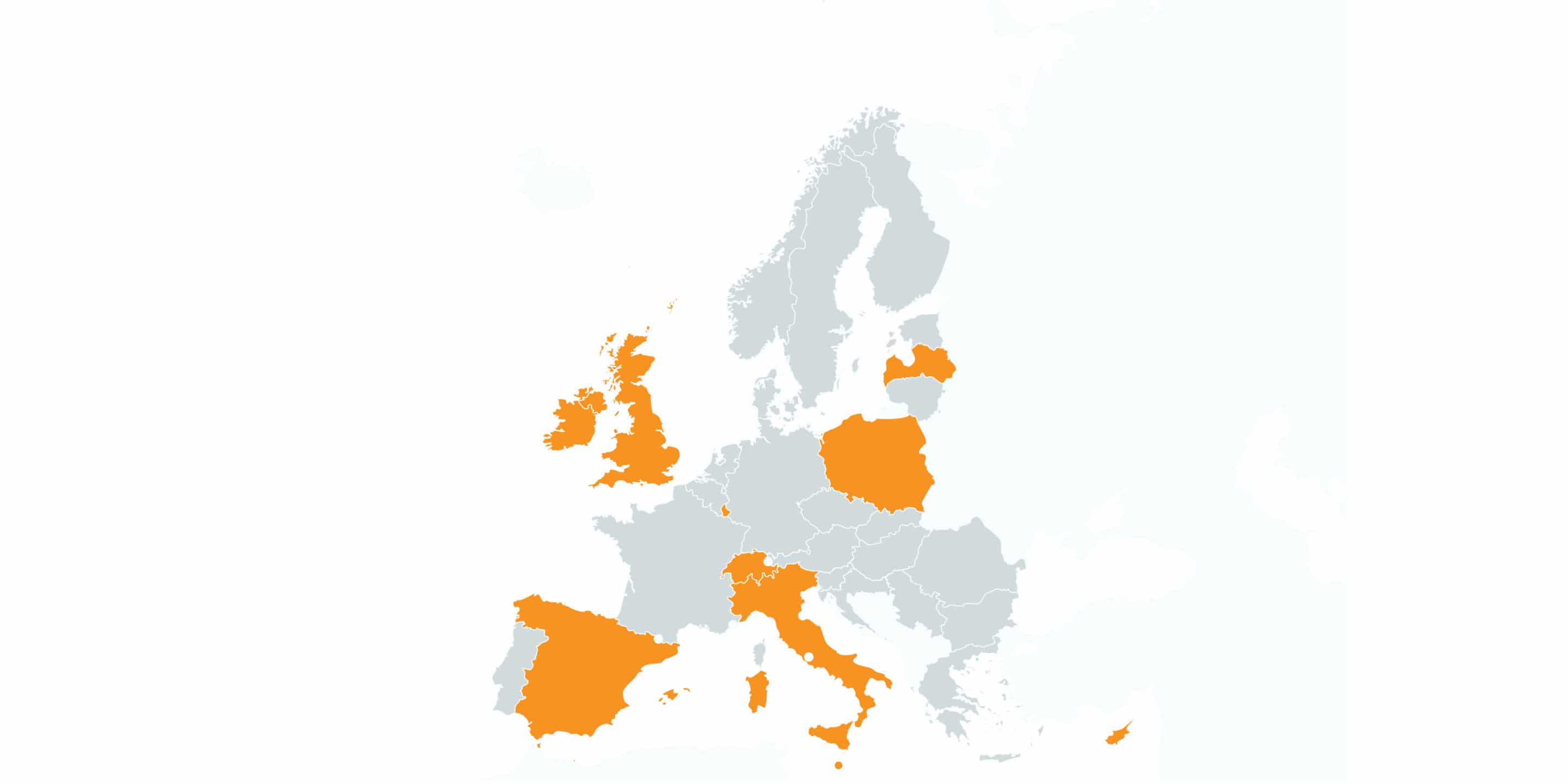

VAT - Monthly Alert - November/December 2019: Country specific - Austria/Czech Republic/Germany/Netherlands/Spain/Slovenia - Lexology